Which Statement Best Describes How An Investor Makes Money Off Debt?

Sample Investor Questionnaire

Investment Time Horizon: The length of your investment time horizon impacts the types of investments that may be suitable for you. Investors with a time horizon of greater than three years have a greater degree of flexibility when building a portfolio (although risk tolerance and investment objectives must also be considered). If you have a very short time horizon, more conservative investments like GICs or money market funds may be the only suitable option for you.

- When do you expect to need to withdraw a significant portion (1/3 or more) of the money in your investment portfolio?

- Less than 1 year

- 1-3 years

- 4-6 years

- 7-9 years

- 10 years or more

Investment Knowledge: If you have a high level of investment knowledge, you have a good understanding of the relative risk of various types of investments and understand how the level of risk taken affects potential returns. If you have very little knowledge of investments and financial markets, speculative and high risk investments and strategies are likely not suitable options for you.

- Which statement best describes your knowledge of investments?

- I have very little knowledge of investments and financial markets.

- I have a moderate level of knowledge of investments and financial markets.

- I have extensive investment knowledge; understand different investment products and follow financial markets closely.

Investment Objectives: Investment objectives are the goal or result you want to achieve from investing. Understanding your investment goals helps determine the types of investments best suited to meet your needs. The investment products used to meet different goals have varying levels of risk and potential returns.

- What is your primary goal for this portfolio:

- I want to keep the money I have invested safe from short-term losses or readily available for short-term needs. (Safety – Investments that will satisfy this objective include GICs and money market funds)

- I want to generate a steady stream of income from my investments and I am less concerned about growing the value of my investments. (Income – Investments that will satisfy this objective include fixed income investments such as funds that invest in bonds)

- I want to generate some income with some opportunity for the investments to grow in value. (Balanced – A balanced fund or a portfolio that includes at least 40% in fixed income investments and no more than 60% in equity funds will satisfy this objective)

- I want to generate long-term growth from my investments. (Growth – A portfolio with a relatively high proportion of funds that invest in equities will satisfy this objective if you also have a long time horizon and are willing and able to accept more risk)

Risk Capacity (Questions 4-9): Your financial situation including your assets, debt and the amount and stability of your income are all important when determining how much risk you can take with your investments. In addition, the larger the portion of your total assets that you are investing, the more conservative you might wish to be with this portion of your portfolio.

- What is your annual income (from all sources)?

- Less than $25,000 (0 points)

- $25,000 – $49,999 (2 points)

- $50,000 – $74,999 (4 points)

- $75,000 – $99,999 (5 points)

- $100,000 – $199,999 (7 points)

- $200,000 or more (10 points)

- Your current and future income sources are:

- Stable (8 points)

- Somewhat stable (4 points)

- Unstable (1 points)

- How would you classify your overall financial situation?

- No savings and significant debt (0 points)

- Little savings and a fair amount of debt (2 points)

- Some savings and some debt (5 points)

- Some savings and little or no debt (7 points)

- Significant savings and little or no debt (10 points)

- What is your estimated net worth (investments, cash, home and other real estate less mortgage loans and all other debts)?

- Less than $50,000 (0 points)

- $50,000 – $99,999 (2 points)

- $100,00 – $249,999 (4 points)

- $250,00 – $499,999 (6 points)

- $500,000 -$999,999 (8 points)

- $1,000,000 or more (10 points)

- This investment account represents approximately what percentage of your total savings and investments. (Total savings and investments include all the money you have in cash savings, GICs, savings bonds, mutual funds, stocks and bonds)?

- Less than 25% (10 points)

- 25%-50% (5 points)

- 51%-75% (4 points)

- More than 75% (2 points)

- What is your age group? (Your age is an important consideration when constructing an investment portfolio. Younger investors may have portfolios that are primarily invested in equities to maximize potential growth if they also have a higher risk tolerance and long investment time horizon. Investors who are retired or near retirement are often less able to withstand losses and may have portfolios that are invested to maximize income and capital preservation)

- Under 35 (20 points)

- 35-54 (8 points)

- 55-64 (3 points)

- 65 or older (1 point)

Your score for questions 4-9 __________

Risk Attitude (Questions 10-15): Your comfort level with risk is important in determining how conservatively or aggressively you should invest. Generally speaking, you need to consider accepting more risk if you want to pursue higher returns. If you decide to seek those potentially higher returns, you face the possibility of greater losses.

- In making financial and investment decisions you are:

- Very conservative and try to minimize risk and avoid the possibility of any loss (0 points)

- Conservative but willing to accept a small amount of risk (4 points)

- Willing to accept a moderate level of risk and tolerate losses to achieve potentially higher returns (6 points)

- Aggressive and typically take on significant risk and are willing to tolerate large losses for the potential of achieving higher returns (10 points)

- The value of an investment portfolio will generally go up and down over time. Assuming that you have invested $10,000, how much of a decline in your investment portfolio could you tolerate in a 12 month period?

- I could not tolerate any loss (0 points)

- -$300 (-3%) (3 points)

- -$1,000 (-10%) (6 points)

- -$2,000 (-20%) (8 points)

- More than -$2,000 (more than -20%) (10 points)

- When you are faced with a major financial decision, are you more concerned about the possible losses or the possible gains?

- Always the possible losses (0 points)

- Usually the possible losses (3 points)

- Usually the possible gains (6 points)

- Always the possible gains (10 points)

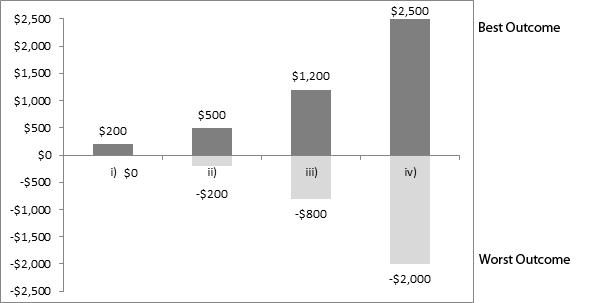

- The chart below shows the greatest one year loss and the highest one year gain on four different investments of $10,000. Given the potential gain or loss in any one year, which investment would you likely invest your money in:

- EITHER a loss of $0 OR a gain of $200 (0 points)

- EITHER a loss of $200 OR a gain of $500 (3 points)

- EITHER a loss of $800 OR a gain of $1,200 (6 points)

- EITHER a loss of $2,000 OR a gain of $2,500 (10 points)

Range of Possible Outcomes in 1 Year

- From September 2008 through November 2008, North American stock markets lost over 30%. If you currently owned an investment that lost over 30% in 3 months you would:

- Sell all of the remaining investment to avoid further losses (0 points)

- Sell a portion of the remaining investment to protect some of your capital (3 points)

- Hold onto the investment and not sell any of the investment in the hopes of higher future returns (5 points)

- Buy more of the investment now that prices are lower (10 points)

- Investments with higher returns typically involve greater risk. The charts below show hypothetical annual returns (annual gains and losses) for four different investment portfolios over a 10 year period. Keeping in mind how the returns fluctuate, which investment portfolio would you be most comfortable holding?

- Portfolio A (0 points)

- Portfolio B (4 points)

- Portfolio C (6 points)

- Portfolio D (10 points)

Your score for questions 10-15__________

On the table below circle your answers to the time horizon, investment knowledge and investment objectives questions and your total scores for the risk capacity and risk attitude questions.

Your investor profile is determined by the circle that is in the column furthest to the left in the table.

| 1 | 2 | 3 | 4 | 5 | |

| Time Horizon (question 1) | i | ii | iii, iv | v | |

| Investment Knowledge (question 2) | i | ii | iii | ||

| Investment Objectives (question 3) | i | ii | iii | iv | |

| Risk Capacity (total of questions 4-9) | <15 | 15-25 | 26-40 | >40 | |

| Risk Attitude (total of questions 10-15) | <20 | 20-24 | 25-30 | 31-45 | >45 |

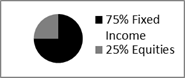

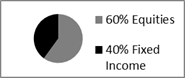

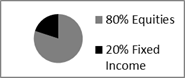

Sample Investor Profiles and Asset Allocations

| AssetAllocation |

| Asset Allocation |

| Asset Allocation |

| Asset Allocation |

| Asset Allocation |

Illustrative Examples

On the table below circle your answers to the time horizon, investment knowledge and investment objectives questions and your total scores for the risk capacity and risk attitude questions.

Your investor profile is determined by the circle that is in the column furthest to the left in the table.

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Time Horizon (question 1) | i | ii | iii, iv | v | |

| Investment Knowledge (question 2) | i | ii | iii | ||

| Investment Objectives (question 3) | i | ii | iii | iv | |

| Risk Capacity (total of questions 4-9) | <15 | 15-25 | 26-40 | >40 | |

| Risk Attitude (total of questions 10-15) | <20 | 20-24 | 25-30 | 31-45 | >45 |

In this example, although the client expressed a willingness to accept risk, they have very limited risk capacity (ability to withstand losses). The client's Risk Capacity is the most constraining element, leading to a Conservative Income profile.

| 1 Safety | 2 Conservative | 3 Balanced | 4 Growth | 5 Aggressive | |

|---|---|---|---|---|---|

| Time Horizon (question 1) | i | ii | iii, iv | v | |

| Investment Knowledge (question 2) | i | ii | iii | ||

| Investment Objectives (question 3) | i | ii | iii | iv | |

| Risk Capacity (total of questions 4-9) | <15 | 15-25 | 26-40 | >40 | |

| Risk Attitude (total of questions 10-15) | >20 | 20-24 | 25-30 | 31-45 | <45 |

In this example, the client has significant financial resources but is unwilling to take any risk with their investments. The client's Risk Attitude is the most constraining element, leading to a Safety profile.

Which Statement Best Describes How An Investor Makes Money Off Debt?

Source: https://mfda.ca/ipq/

Posted by: bahenaxviver.blogspot.com

0 Response to "Which Statement Best Describes How An Investor Makes Money Off Debt?"

Post a Comment