How Much Money Should I Invest In Bitcoin

Interest in Bitcoin has surged over the last few years – everyone from governments to grandmothers are talking about it, however, there is still much uncertainty on how to actually invest in it and the reasons why people are doing so.

This article aims to help you understand why Bitcoin's popularity has increased so much and how to do so using different investment strategies via trusted cryptocurrency platforms. It may seem intimidating to start getting involved with Bitcoin but it has become incredibly easy to gets started investing in cryptocurrency and you can get started very quickly.

eToro - Our Recommended Crypto Platform

- ASIC, CySEC and FCA regulated - 20 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Staking Rewards for holding ETH, ADA or TRX

- Copytrade Winning Crypto Traders - 83.7% Average Yearly Profit

68% of retail investor accounts lose money when trading CFDs with this provider.

This guide is going to discuss reasons why you should invest in Bitcoin, how to do it and what you need to watch out for to limit risk.

The History of Bitcoin Prices – How has it Grown since 2008?

In October 2008, a paper titled 'Bitcoin: A Peer-to-Peer Electronic Cash System' was written and published by Satoshi Nakamoto. This paper explained the idea behind Bitcoin, outlining exactly how it would operate and describing the details of a completely functional cryptocurrency. Bitcoin works in a fully decentralised system, operating in a trustless manner making it possible to send and receive financial transactions without the need for a third-party. Over 10 years later, this network has grown rapidly and evolved to connect with the needs of its ever-burgeoning user-base.

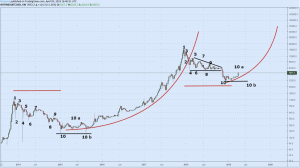

See How the Bitcoin Price Has Increased Over Time

Bitcoin has had a crazy history of up and downs. In March 2010, 10,000 BTC was auctioned for $50 but no buyer was found. A couple months later, L.Haynecz completed the first real-world transaction by buying two pizzas in Florida for 10,000 BTC (an amount that would be over $50m today). Fast forward 7 years and we experienced the parabolic Bitcoin rise in December 2017. Bitcoin hit its all-time-high of $19700 on the 17th December, making many early investors a great amount of profit. Since then, this has still been the top and the price had experienced a rocky 2018, crashing all the way through to Feb 2019 – where the price seems to have bottomed at $3300. The price experienced some sideways action and it has been rising slowly since we saw the $3000s (we are now at around $5000).

On this Page:

Contents [show]

Best Bitcoin Exchange in November 2021

Bitcoin

Bitcoin

1 Providers that match your filters

Payment methods

Coin selection

1 or better

for $ 1000 you get

0.0197BTC

What we like

- Easiest to deposit

- Most regulated

- Copytrade winning investors

for $1000 you get

0.0197 BTC

68% of retail CFD accounts lose money.

Compare Bitcoin Brokers & Exchanges

| 5.0 | 4.9 | 4.8 | 4.7 | 4.6 | 4.5 | 4.4 | 4.3 | 4.2 | 4.1 | 4.0 |

| 10/10 | 9/10 | 8/10 | 9/10 | 8/10 | 9/10 | 9/10 | 8/10 | 9/10 | 8/10 | 9/10 |

| Spreads | Spreads | Spreads | Spreads | Spreads | 0.1% | 0.1% | 0.1% | 0.50% | 0.1% | Spreads |

| N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| $5 | N/A | N/A | N/A | N/A | 0.0005 BTC | N/A | N/A | N/A | N/A | N/A |

| $57674.45 | $57899.35 | $57726.35 | $57870.52 | $60593.91 | $57711.93 | $60595.52 | $60609.62 | $60582.00 | $60425.13 | $58533.71 |

| $4683.50 | $4628.34 | $4600.77 | $4612.26 | $4279.54 | $4599.62 | $4286.32 | $4282.79 | $4281.94 | $4268.89 | $4711.07 |

| $1.02 | $1.01 | $1.00 | $1.01 | $1.10 | N/A | $1.10 | $0.23 | $0.30 | N/A | $1.02 |

| $1.00 | N/A | N/A | N/A | $1.00 | $1.00 | N/A | $1.00 | $1.00 | N/A | $1.01 |

| $212.44 | $209.52 | N/A | $209.73 | $235.21 | N/A | $235.63 | $234.94 | $234.72 | N/A | $213.69 |

| $583.59 | $580.16 | N/A | $579.87 | $607.38 | N/A | $606.20 | $506.41 | $605.00 | N/A | $581.30 |

| $25.23 | $25.28 | N/A | $25.61 | $29.87 | N/A | $29.77 | $29.60 | $29.76 | N/A | N/A |

| $1.64 | $1.62 | $1.59 | N/A | $1.89 | N/A | $1.90 | $1.90 | $1.90 | N/A | $1.61 |

| $1.46 | $1.42 | N/A | $1.42 | $1.27 | $1.40 | $1.91 | N/A | $1.91 | $1.20 | $1.45 |

| $642.18 | $627.45 | $738.71 | N/A | N/A | $627.29 | $583.50 | N/A | N/A | N/A | $633.09 |

| $0.35 | $0.34 | $0.34 | $0.34 | $0.35 | N/A | $0.35 | $0.07 | $0.35 | $0.08 | $0.35 |

| $151.54 | $150.64 | N/A | N/A | $166.36 | N/A | N/A | $182.50 | N/A | N/A | $151.54 |

| $1.01 | N/A | N/A | N/A | $1.00 | N/A | N/A | $1.00 | N/A | N/A | N/A |

| $4.13 | $4.05 | N/A | $4.07 | $4.35 | $4.02 | $4.38 | $4.39 | $4.38 | $4.37 | $4.07 |

| $243.09 | $244.05 | N/A | N/A | $124.02 | $240.86 | N/A | N/A | N/A | N/A | N/A |

Top 11 Reasons Why You Should Invest in Bitcoin?

We believe Bitcoin's price will rise from its current value for a number of reasons. Markets work in cycles and the hype of 2017/2018 has cooled off with the price correcting accordingly. When hype has reduced and the price has stabilised – that is when you need to start accumulating and investing, and that time happens to be now. That is just one reason why you should invest in Bitcoin, take a look below to see more solid arguments for getting yourself involved in the cryptocurrency market.

1. Buy Low Sell High – Ability to Profit from Low Prices in a Bear Market

Bitcoin has been the most exciting asset to invest in for decades, the profitable gains that are possible trading Bitcoin are second to none. There have been huge rises in the past and when we saw the highs of December 2017 many people would have rushed to buy anything below $10000. Now Bitcoin is around $5000, people have lost confidence due to the past rough year – but in fact this is the time you need to start accumulating. The price is low compared to the all-time-high so it makes sense to accumulate at a low price and sell at the highs (and above). The market works in cycles, and you can see from the above chart we have had a healthy correction – the new cycle is ready to start that could spark another parabolic movement.

2. Young Market and Tech – Plenty of Ways for Demand to Increase

Bitcoin's potential huge gains are not the only thing making it such an exciting asset. The fact that that both the technology and market are so young means there is so much room for improvement and therefore price growth. In the grand scheme of things, people investing now could still be seen as early investors. Bitcoin is around 10 years old and the amount of work being done on blockchain is increasingly massively each year. Bitcoin developers are always at work and the code is being worked on non-stop to increase scalability, privacy and other impressive features. The potential growth for Bitcoin is unimaginable. The higher the market cap grows, the higher the prices rise due to more money circulating.

3. Increasingly High Adoption Rate – Only 1% of the World own Bitcoin

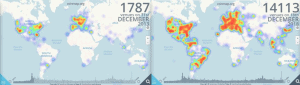

The adoption rate for Bitcoin is growing at an extremely impressive rate. In 2013 there were 1,789 merchants accepting Bitcoin. In December 2018 there were 14,346 venues globally accepting BTC, which is a massive 700% rise – indicating that adoption is growing constantly and will continue to do so throughout the years. More and more people want to use digital currencies for their everyday purchases. Looking at the above infographic, we can see that countries experiencing issues with corruption, difficult monetary policies and hyperinflation (Venezuela) are adopting Bitcoin the fastest and rightly so. People are losing faith in their own country's currencies and are warming up to cryptocurrencies. This would positively impact because more people using and buying Bitcoin increases demand, which will increase the price as the supply is capped.

4. The Launch of a Bitcoin ETF and Institutional Investors will Drive the Price Up

The potential of publicly trade bitcoin ETFs should not be ignored. An exchange-traded fund is an investment fund that follows the price of an underlying asset (such as gold) and is traded on exchanges. Since regulated bitcoin futures contracts are now on the CME and CBOE, the chances of an approved ETF are improving. ETFs would legitimise BTC further and would attract all kinds of investors, especially institutional investors. It would also remove barriers for the masses to invest. In the early 2000s, the ETF market opened for gold and the price rallied for years, the same could happen for Bitcoin. As an approved ETF would remove barriers to entry, a huge spike increase would be likely.

5. Own Your Money – Decentralisation

Start owning your money! Bitcoin is decentralised, meaning you own the coins and transactions. Banks and other third parties are not involved and you have access to deposit and withdraw money 24 hours a day, 7 days a week. A great example of where decentralised money would be extremely effective was during the Greek financial crisis, where citizens were not even able to withdraw their own cash due to a government lock down to pay off debts. Bitcoin is available to withdraw whenever you want, no matter the situation of the government. We are in a time where people are becoming increasingly worried about their money, and decentralised forms of payment are becoming more desirable which would drive the price up.

6. Bitcoin Supply is Limited – The Price can only increase with Demand

If every millionaire in the world wanted one Bitcoin, it would not be possible! There are only 21million Bitcoins available in total, and 17.6million have already been mined. New research also claims there could be up to 4million Bitcoins already lost, decreasing the supply even further than it already is. It is similar with gold, gold must be mined out the ground and Bitcoin must be mined via complex algorithms. Demand will increase with the years to come, and with that value increases also.

7. Sending Money Overseas Made Easy

International bank transfers are still very difficult to do, they take much longer than national transactions and the fees are much more expensive. Bitcoin removes the middle man and allows you to send payments anywhere in the world instantly for low fees. It allows you more freedom and privacy when handling your money, which is crucial these days. Using standard bank accounts are somewhat old fashioned, so it's worth investing in this new piece of technology, removing barriers and allowing people to send money to each other no matter where they live.

8. Metcalfe's Law and Bitcoin – High adoption with Push the Price up Exponentially

Metcalfe's Law is a term coined by Robert Metcalfe that states that the value of a network grows by the square of the size of the network. The idea behind this law is that a network's value is increased as the size of the network increases. For example, approximately 0.7% of the population use Bitcoin so (0.72 =0.49), but if we saw an increase to 2% of the population using Bitcoin, then the value of the network would quadruple (22 =4), if 4% of the population used Bitcoin then the value would of the network x16 (42 =16) and so on. The value of the network quadrupling would also push the price exponentially – there is no limit to what price Bitcoin can hit!

9. Privacy and Anonymity

Lack of privacy and anonymity is becoming an increasing issue in 2019. Bitcoin operates differently to your usual banking network. Opening a bank account requires lots of effort, identification and sometimes cost. You could use Bitcoin to keep your funds anonymous, an interesting example is a domestic abuse victim could use Bitcoin to safely and securely save funds to prepare for an independent life. Privacy and anonymity is something people are beginning to value more nowadays due to increased hacks, malware and viruses. If people are valuing privacy and anonymity more, they will with Bitcoin too.

10. Flexibility in the Market

Investing and trading Bitcoin can be done on any day at any time. Giving you flexibility to work with your investments and no barriers. Unlike stocks you do not need to wait for the market to open to handle trades and your investments. This gives investors and traders more freedom with their money. Flexibility is valued and traders do not want to be told when they can and can't trade with their own capital. Thus, this will be positive and drive the price as the flexibility is attractive to traders.

11. Increasing Regulation

There is increasing regulation when it comes to Bitcoin and cryptocurrencies but this is not necessarily a bad thing. With more regulation, the asset will gain trust and adoption will increase. As stated in one of the previous points, increased adoption is one of the quickest ways Bitcoin can rise in price. Investing in Bitcoin will be safer and information about the asset will be much more clear, bringing in many more investors. Governments are constantly discussing Bitcoin and other cryptos, showing that it is here to stay.

How to Take Advantage of Investing in Dips in the Market

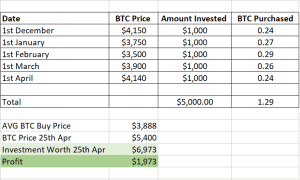

Since the beginning of 2019, buying every significant Bitcoin dip has proved to be a rewarding strategy. Dollar-Cost Averaging (DCA) is a popular trading strategy that involves buying the same dollar amount of an investment regularly. Entry points can be daunting for investors so this method decreases the importance of short-term volatility and allows investors to scale into an asset. People have become more reluctant to invest in cryptocurrencies due to the latest crash from the 2017 highs, but the market has been correcting since and some stability has been found. There is good risk/reward 'DCAing' the dips on Bitcoin and could prove to be very rewarding in say a years time.

The above table breaks down Dollar Cost Averaging with an example of buying on the 1st of every month from December 2019. If you had invested $1000 at the 1st of every month since then you would have made just under $2000 today from simply buying Bitcoin, not even day trading. This is a great time to start scaling into Bitcoin so if you're not feeling extremely confident just invest what you can, once a month!

Overview: What are the Benefits and Risks of Investing in Bitcoin?

Benefits of Bitcoin Investments

✅ Possibility of huge profit margins

✅ Low fees

✅ Control and security

✅ 24/7 Trading – market does not close

✅ Fast transactions

✅ Anonymity

✅ No inflation risks

Risks of Bitcoin

❌ Volatile market

❌ Lack of historical data

❌ Chance of cybertheft

❌ Little regulation

Can You Invest in Bitcoin Mining?

There are various ways to invest in Bitcoin, and an interesting one is mining Bitcoin. Bitcoin is a decentralised system which keeps running via its decentralised workforce. The miners are this workforce and they get paid in newly minted Bitcoins for keeping the infrastructure running. It is similar to a tax on everyone who owns Bitcoins. In the earlier days of Bitcoin mining was extremely lucrative as you could earn a lot of BTC due to the competition being limited, however, now mining is a massive industry with huge warehouses being built solely for mining cryptocurrencies. Today the easiest way to get into mining is usually through an application-specific integrated circuit (ASIC) miner which is still a rather heavy investment that comes with electricity costs, hardware costs and takes time. There are plenty of tutorials online that can show you how to get started with your own mining rig.

Is it Too Late to Invest in Bitcoin?

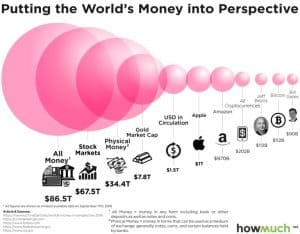

The short answer – absolutely not! The current total market cap of the crypto industry is under $200bn. Companies such as Amazon and Apple have market caps of around 1 trillion which just goes to show exactly how young Bitcoin and the crypto market is as a whole. The technology is still in its early stages and you'd be crazy to write off blockchain and Bitcoin. Many of today's top companies are exploring the use of blockchain technology such as Facebook, American Express, IBM and many more! The number of companies that will use blockchain will only increase with years to come, and this will benefit the cryptocurrency industry as a whole.

The crypto market has slowly bled out since January 2018 but we experienced a positive bounce from the $3300 low in February and the price is stabilising and seems to be slowly picking up the pace. It is understandable that people are somewhat reluctant to invest in Bitcoin but that's why you can start with however much you can afford and using the Dollar-cost-averaging method mentioned above, you can slowly scale yourself in.

Countries that are experiencing financial crises or corruption have currencies with hyperinflation (such as in Venezuela and Zimbabwe) are adopting cryptocurrencies faster than any other countries and it's likely this will continue because Bitcoin can offer people financial freedom and protection from corruption due to its trustless, decentralised system. Less than 1% of the population use Bitcoin so it is still early, and definitely not too late!

How to Invest in Bitcoin on our Recommended Platforms in our Step-by-Step Guide:

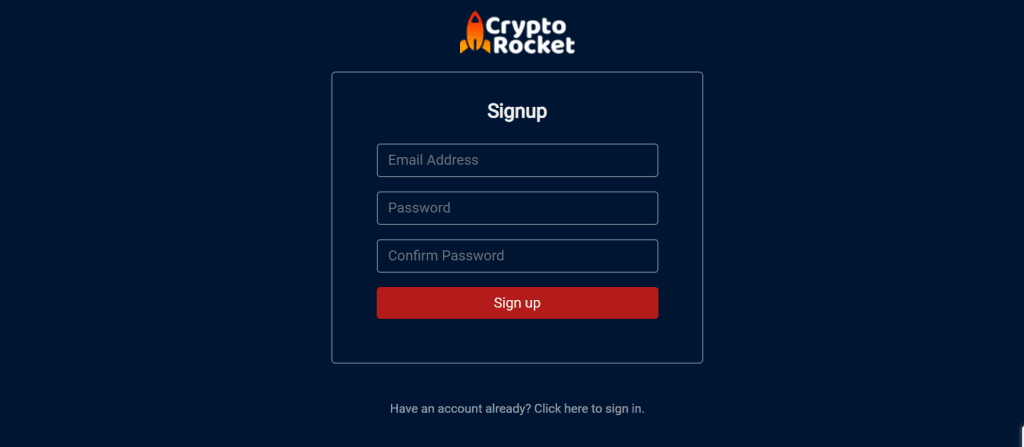

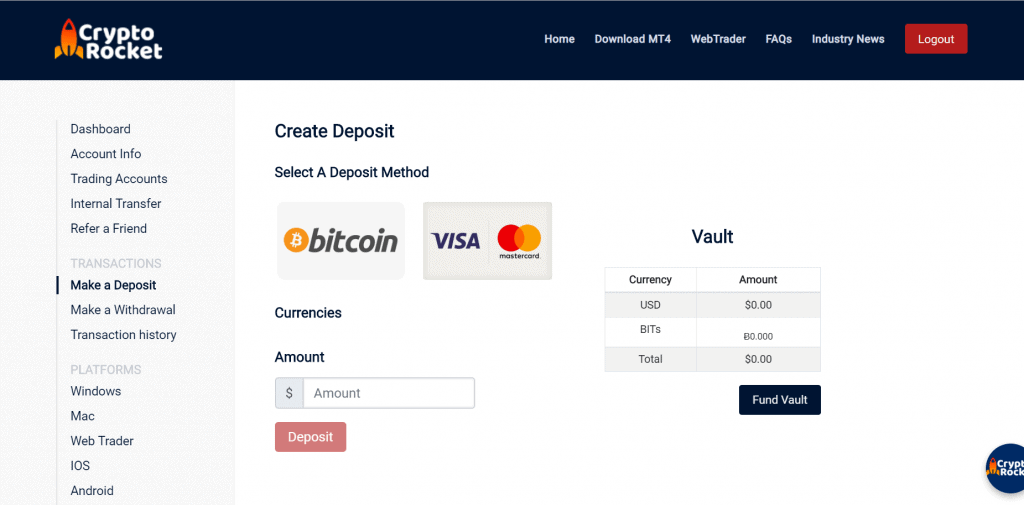

Investing in Bitcoin can seem like an intimidating task at first, but our recommended platform CryptoRocket has made investing in Bitcoin and other cryptocurrencies easier than ever! There is a great selection of cryptocurrencies to choose from and you can enjoy low fees.

How to invest in Bitcoin on CryptoRocket (Step by Step)

Step 1: Registration

To register on CryptoRocket you will have to visit the official website and click on "sign up", which will lead you to a registration form. You will have to type in your full name, email address and create a password to be able to register.

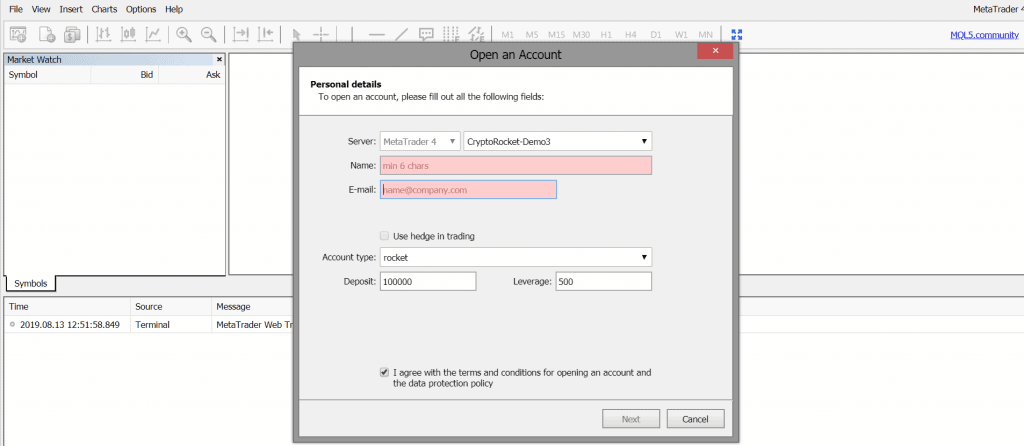

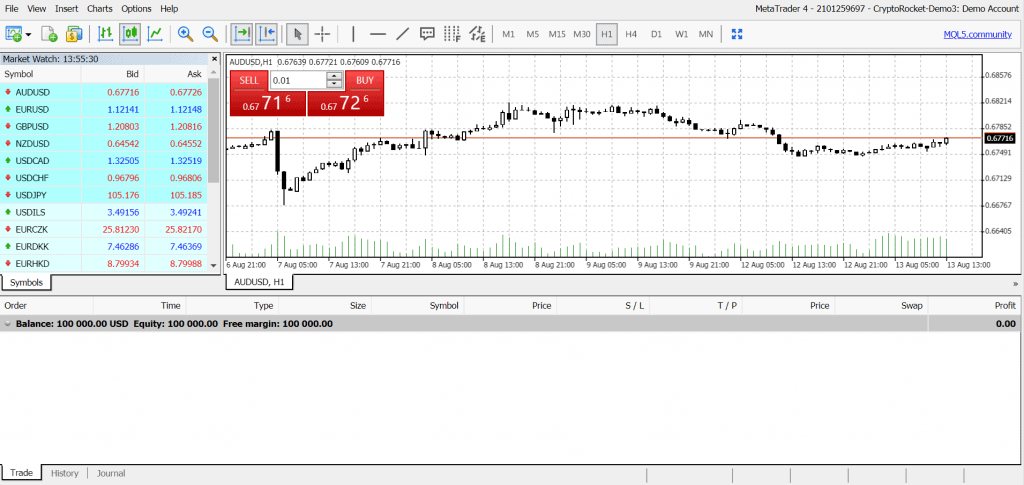

Step 2: Opening Trading Account

You will then be required to create a trading account. All you have to do is click on "Open Trading Account" after you sign up, which will allow you to create a demo account a try the trading platform without getting real money involved.

Step 3: Deposit funds

Once you feel ready to start trading with real money you can make your deposit. The payment methods allowed include credit/debit cards and Bitcoin. You will have to deposit a minimum of $10 to be allowed to access the trading space.

Step 4: Buying

You can now switch to a real account and invest in bitcoin. To do that, all you have to do is access the trading platform through WebTrader or MT4. On the left side you will see the list of assets on offer. Scroll down until you find Bitcoin, then select it and decide whether you want to "buy" or "sell" it.

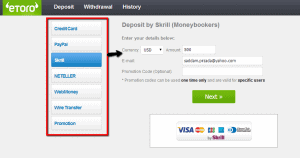

How to Invest in Bitcoin on eToro (Step by Step)

Step 1: Sign up to eToro

Signing up to eToro is incredibly easy, click this link to create your account and fill in your details. You will just need to put in your name, username, e-mail, password and phone number. Accept the terms & conditions and click on start trading!

After signing upyou will be free to explore the platform's various features. There is a watchlist to add all your favourite cryptocurrencies, a newsfeed to see different trader's opinions and open trades and you'll be free to explore all the different markets that eToro has to offer.

Before you start trading you'll be asked some simple questions and required to upload some ID verification. The verification process with eToro is very quick and you should be fully verified within a couple hours. This will give you full access to the platform, enabling you to deposit, withdraw and trade your desired funds.

Step 2: Fund your account

Once your account is fully verified it's time to fund your account. A huge advantage here is that you can deposit with various methods, including debit card, credit card and even PayPal! The minimum deposit, however, is $200.

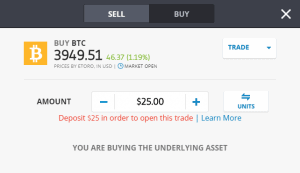

Step 3: Buying Bitcoin

The third and final step can be completed within seconds! Click 'Trade Markets' on the side bar, choose 'Crypto' from the top of the search filter then you will see Bitcoin right at the top.

Click 'Buy' and this box will pop up. Set the amount you want to invest and then confirm. You will have now invested in the most exciting asset of our time, Bitcoin!

eToro - Our Recommended Crypto Platform

- ASIC, CySEC and FCA regulated - 20 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Staking Rewards for holding ETH, ADA or TRX

- Copytrade Winning Crypto Traders - 83.7% Average Yearly Profit

68% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions

Can I use Paypal to invest in Bitcoin?

Yes. Even though it is quite rare to find platforms that allow you to deposit with Paypal - eToro fortunately accept Paypal deposits as well as credit and debit card!

Do you have to buy a whole Bitcoin?

No. People can often get confused thinking you must buy a whole Bitcoin to own Bitcoin. You can buy them in decimals (such as 0.01 BTC) so it's possible to start investing with as much as you'd like.

Is Bitcoin legal?

Bitcoin is 100% legal and every year governments are respecting it more, talking about it and thus legitimising it further.

What is BTC? Is it different to Bitcoin?

No. BTC is just the ticker for Bitcoin, and people will often use that as a shorter way to say it.

Is Bitcoin the only cryptocurrency you can invest in?

10 years ago, yes. Now in 2019 there are thousands of cryptocurrencies people can invest in. Other popular cryptocurrencies include Ethereum (ETH) and Ripple (XRP).

What does raising the leverage do?

Raising the leverage refers to various techniques that can increase your profits by increasing your risk. If the trade is not on X1 leverage then you are trading a CFD and not the underlying asset. Only experienced traders should use leverage.

Is Bitcoin Cash the same as Bitcoin?

No. Bitcoin cash is a fork of Bitcoin that was started by bitcoin miners and developers. It operates differently and is nowhere near as popular.

Is it easy to mine Bitcoin?

If you are completely new to mining you will definitely have to research further online on how to mine Bitcoin. ASIC miners have made it easier for people to start mining but it still requires some research and reading.

How Much Money Should I Invest In Bitcoin

Source: https://insidebitcoins.com/how-to-invest-in-bitcoin

Posted by: bahenaxviver.blogspot.com

0 Response to "How Much Money Should I Invest In Bitcoin"

Post a Comment